By Kate Cotterill, Hub Creative Marketing Agency

Marketers are on red alert right now. We are heading for recession and CMOs and Marketing Directors across the country are looking around nervously as it’s budget setting time for 2023. Historically C-Suite execs largely see marketing and advertising as a luxury and therefore something to cut back on in economic downturns. Here we share the ammunition you need to go into battle for your marketing budget backed up by robust evidence which will help your business accelerate faster out of recession.

What are the effects of slashing marketing spend in a recession?

There are a number of things that happen when competitors cut marketing budget in a downturn:

- Extra potential share of voice is released into the market – fewer companies competing for SOV means it’s easier for your brand to raise its head above the parapet

- Cost of media buying is reduced due to lower demand – so you can either buy more or buy the same for less budget which can be reallocated elsewhere

- Reduced brand awareness for competitor brands – consumers are after all fickle creatures even for high value products and investments, so while competitor brands are quiet, your brand can increase awareness for the target audience

- Marketing budget slashing brands are less likely to be front of mind and therefore not in the consideration set

- Cutting marketing activity sets businesses back so that they have to start from a poor position post recession when they reintroduce proper budgets, which takes them years to recover from

We are not alone in our worry about our budgets. The IPA have stepped up in defence with their recent campaign triggered by the cost of living business Tsar working for the UK government recently recommending businesses redirect marketing spend to reduce price for the consumer. The move rang alarm bells in many a marketer’s heads and The IPA’s Director of Marketing, Janet Hull OBE was quick to respond, “We are concerned that, while this guidance may appear socially relevant in the current moment, it is not founded on sound marketing principles.” The IPA placed print ads warning C-Suite Executives against cutting marketing budgets based on years of evidence collated by the IPA.

The killer evidence you need to defend your budgets

There was a landmark study done by Nitin Nohria in 2008, it is the best and most comprehensive study out there that you can use to support your case. The research group conducted a year-long project to analyse strategy selection and corporate performance during the past three global recessions: the 1980 crisis (which lasted from 1980 to 1982), the 1990 slowdown (1990 to 1991), and the 2000 bust (2000 to 2002). They studied 4,700 public companies, breaking down the data into three periods: the three years before a recession, the three years after, and the recession years themselves.

The study’s findings were, “stark and startling. 17% of the companies in our study didn’t survive a recession: They went bankrupt, were acquired, or became private. The survivors were painfully slow to recover from the battering. About 80% of them had not yet regained their pre recession growth rates for sales and profits three years after a recession; in fact, 40% of them hadn’t even returned to their absolute pre recession sales and profits levels by the end of that time period. Only a small number of companies—approximately 9% of sample—flourished after a slowdown, doing better on key financial parameters than they had before and outperforming rivals in their industry by at least 10% in terms of sales and profits growth. These postrecession winners aren’t the usual suspects. Firms that cut costs faster and deeper than rivals don’t necessarily flourish. They have the lowest probability—21%—of pulling ahead of the competition when times get better, according to our study. Businesses that boldly invest more than their rivals during a recession don’t always fare well either. They enjoy only a 26% chance of becoming leaders after a downturn. And companies that were growth leaders coming into a recession often can’t retain their momentum; about 85% are toppled during bad times.”

As a result of the research, the group identified that there were 4 different responses from businesses to slowdown;

- Prevention-focused companies, which make primarily defensive moves and are more concerned than their rivals with avoiding losses and minimising downside risks.

- Promotion-focused companies, which invest more in offensive moves that provide upside benefits than their peers do.

- Pragmatic companies, which combine defensive and offensive moves.

- Progressive companies, which deploy the optimal combination of defence and offence.

Spoiler alert – the clear winner and the group that came out of recession in great shape and gained market share were the ‘progressive companies’ who formed 37% of the 4,700 companies. So what were the traits these companies portrayed?

“These companies’ defensive moves are selective. They cut costs mainly by improving operational efficiency rather than by slashing the number of employees relative to peers. However, their offensive moves are comprehensive. They develop new business opportunities by making significantly greater investments than their rivals do in R&D and marketing”

Postrecession Leaders in Sales and Profits Growth

So, a focus on thrive not survive is a clear winner historically across the recessionary periods this study covered and is certainly a more than comprehensive indicator of what companies should be thinking about in today’s gloomy market.

Gain market share in a recession, don’t just defend it

One of Hub’s favourite marketers is the iconic Mark Ritson. He too feels passionately that brands should not cut marketing spend in and around recession. In the midst of the Covid gloom he shared his 9 step playbook on how brands should be approaching marketing in a very challenging period. He urged brands to keep a firm eye on the long term and to capitalise on the excess share of voice in the marketplace. “Companies that maintain ad spend, or even increase it, during a recession saw little advantage during the hard months of the squeeze. But the minute the green shoots of growth appeared, their growth was spectacularly superior versus competitors that cut back during the recession.”

He backs up the thought that in fact it’s the perfect time to grow your share of voice in the marketplace which can have transformative effects in the long term. “If your category cuts half its ad spend and you maintain your ad spend, for example, you get a massive boost in your ESOV [Extra share of voice] simply because everyone else is investing relatively less.”

Source: Marketing Week – Ritson’s recession playbook

Learn from historical data – more ammunition for your argument

The IPA [Institute for Practitioners in Advertising] are the gold standard for we marketers as their awards truly represent the best interests of the client – effectiveness. If we do in fact enter a recession in the near future, this will be the fourth recession in the IPA awards‘ history. Given that the IPA awards are rooted in effectiveness, the evidence is hard to ignore. The aptly titled paper, ‘When others go quiet your voice gets louder’, they focus on two key real world findings:

- Advertising in recession can help firms recover better – preventing loss in market share is key. See the below Malik Profit study in Market Strategy (PIMS), from 1,000 business units in the 2001 slump and from earlier recessions. In both datasets, businesses that increased marketing spend as a proportion of market size reported higher market share growth in the first two years of recovery than those cutting or maintaining budgets.

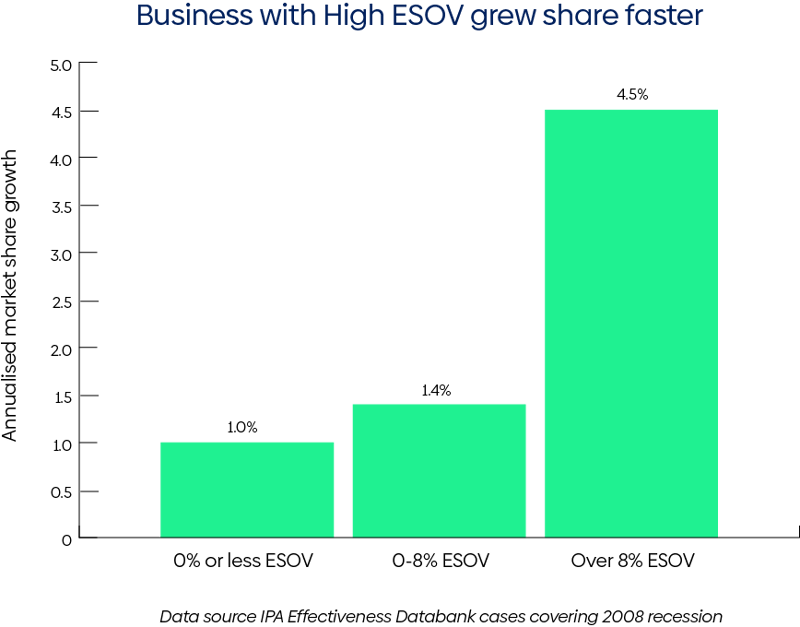

- Businesses with high ESOV [Extra Share of Voice] grew market share many times faster post recession. To Mark Ritson’s point, capitalising on the extra share of voice available when other brands are cutting back on marketing spend.

Source: IPA – When other go quiet, your voice gets louder

The IPA, rightly, goes on to talk about the importance of effectiveness as simply maintaining spend is not enough. Truly understanding the needs of your audience is never more important than when they are under financial pressure and in fact their needs will have changed in recession. What an opportunity for our many financial services clients to be the helpful investment partner that they need as they face uncertainty. So a shift in strategy may be required to ensure that you’re targeting them with the right messaging at the right time.

So, what should be on your to do list as marketers to ensure your budgets aren’t cut?

- Use the evidence above to build a positive argument for maintaining marketing budgets and take it to the right senior management BEFORE budgets are cut

- Benchmark your current share of voice and marketing metrics now to help with proof points later

- Revisit your strategy to ensure you are effective – how will the financial crisis be affecting your target audience(s)? Is your strategy still on point and should any of the messaging change?

- Capitalise on the unfortunate place we find ourselves financially and present your brand as an ally to your target consumer(s). NB. this must be done with genuine good intent, the brands who take advantage of market factors in a thinly veiled attempt to get ahead are very obvious

- If budget cuts look inevitable, take the time to scenario plan in terms of the impact of those cuts on your business and potential recovery outcomes post recession

The evidence is clear that the best strategy in a financial downturn is to hold your nerve and continue to invest in marketing and advertising. But crucially you should be more laser focused than ever on being effective.

Email us and we will send you an unbranded version of the charts included in this article for you to use in your decks. Contact info@hubagency.co.uk

Further Reading:

https://ipa.co.uk/media/8674/0116_ftresearch_voicegetslouder.pdf

https://ipa.co.uk/media/9030/0116_ftresearch_threemonthsago.pdf

https://ipa.co.uk/media/12179/0116_ftresearch_cuttingbudget_v3.pdf

https://ipa.co.uk/knowledge/publications-reports/advertising-in-a-downturn

https://www.marketingweek.com/mark-ritson-marketing-spend-recession-coronavirus/

https://www.marketingweek.com/ritson-recession-playbook/

https://hbr.org/2019/05/how-to-survive-a-recession-and-thrive-afterward

https://hbr.org/2009/04/how-to-market-in-a-downturn-2