1. Consider information needs carefully

The first thing to say is that not all retail investors are the same. Thinking of them and their information needs as one homogenous mob will get you nowhere. Imagine the differences between a retired fund manager looking after his own portfolio, and a 22 year old, fresh out of university and in their first job looking to get involved (and, yes, they do exist!).

The information required to make an investment decision varies significantly between the two. In the case of the former professional it might involve a full deep dive of the annual report and accounts and then an in-depth trawl of the investment’s factsheets, disclosure documents, and website. Beyond that broker analysis, director dealings, the financial calendar, and press appearances might all play a role. No doubt there would also be detailed analysis of performance charts and comparisons with other investments and benchmarks.

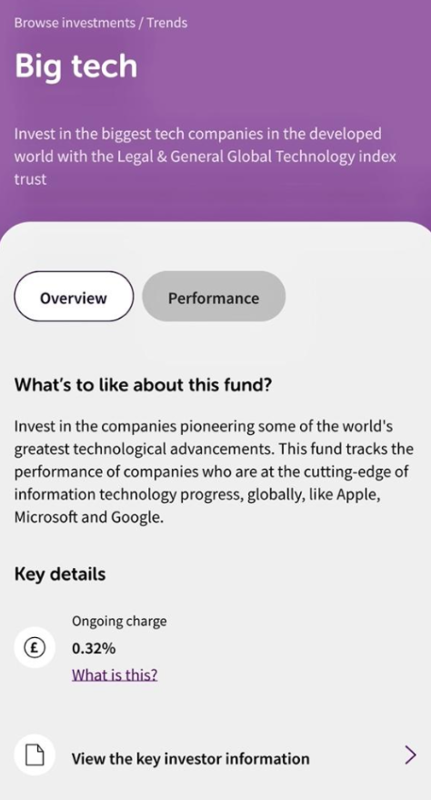

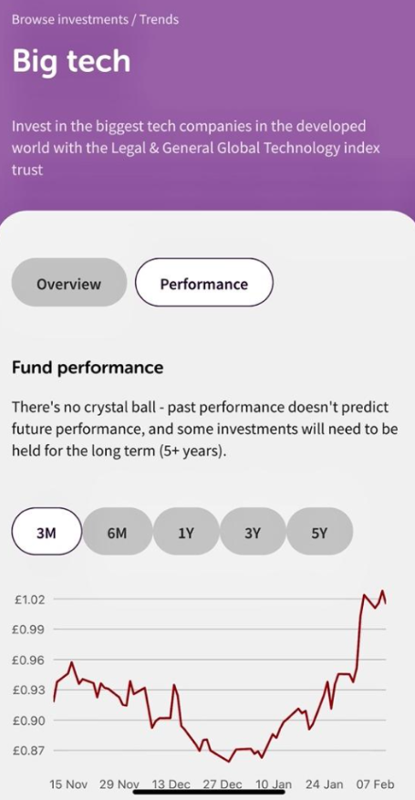

For the newbie grad, their information needs are likely to be much simpler – take a look at Dodl the new investing app from AJ Bell aimed at inexperienced investors and you’ll see what we mean. There’s a logo, a basic description of the investment (and a very small universe from which to choose), and a simple performance chart – see below.

Dodl app by AJ Bell

Of course, there’s a whole gamut of other groups of investors in between these two extremes. But any successful marketing strategy must consider the needs of these groups (segments, in the jargon) before getting on with the business of communicating.

2. Consider how that information is communicated

‘The medium is the message’ – so said Marshall McLuhan in 1964 – and this still holds true today. Once you’ve established the information needs of the groups of investors you’re trying to attract, you’ll also have some insight into the best way to communicate those messages.

For example, a long form written piece such as a white paper is going to be much more appropriate to investors with the time to read it – retirees, perhaps. It’s also going to give you much more opportunity to explore ideas, concepts and themes relevant to your investment proposition. The medium here is the message: we write long detailed papers because we’re the experts and we want to share our insight with you to help you.

Contrast that with dashing off a quick Tweet to let investors know you’ve just announced your latest dividend, for example. Its brevity and immediacy will be relevant to those taking a minute-by-minute interest in their investments. The message: we’re an up-to-date, relevant investment ready to use technology to make sure our audience is on top of the latest news.

But, don’t fall into the trap that it’s one medium per message. If you’ve got something important to say, maybe your annual results or a corporate action where you need investors on board, then don’t hesitate to use as many media (channels) as appropriate: just remember to make the version of the message you’re sending work for that medium.

3. Get the message out there

Many retail investors make decisions based on the media they consume. So if you’re not out there banging the drum, you’re missing out.

You might have a great story with great reasons to buy your investment, but you need to be out there day after day telling that story. In other words, ‘Build it and they will come’ does not apply.

You might be on the first page of Google for the name of your investment (if you’re not there’s something seriously wrong with your website) but are you ranking for ‘best UK income investments’? If that’s the story you have to tell then you need to make sure you’re visible to search engines for that message.

Similarly, if you’re not in the investment press, whether that’s the quality broadsheets through to digital magazines, then you’re missing out on an important outlet for your story that retail investors value and use as part of the mix when making investment decisions.

If you would like to find out how a creative marketing agency in London like Hub can help in developing your investment marketing strategy, get in touch with us here to arrange a call.

Author, Simon Longfellow, is an expert in investment marketing with over 25 years of experience working within the financial services industry. He is the Independent Director of Electric & General Investment Fund, and a non-executive Director of Columbia Threadneedle Global Managed Portfolio Trust – an investment trust investing in other investment trusts to provide shareholders with either growth or a regular income.